Longview Life In Retirement Expo

Join us on Tuesday, October 24, 2023 from 4 pm to 7 pm at the Infinity Event Center Retirement planning is about more than your

Join us on Tuesday, October 24, 2023 from 4 pm to 7 pm at the Infinity Event Center Retirement planning is about more than your

For those seeking a peaceful and vibrant retirement destination, the best places to retire in East Texas present an ideal blend of natural beauty, welcoming

What happens to your pension when you leave a job? That depends on the specific pension plan, whether or not you are vested, and what

If you are nearing retirement, or already there, then “recession” can be a scary word. It can be an even scarier experience. It’s understandable that

If you are wondering how to get help with an inheritance you’ve just received, or expect to soon, here are a few key things to consider.

Belonging Wealth Management is a fiduciary financial advisor in Longview Texas. Our area of expertise is tax-efficient retirement planning. You get a customized plan for

What are some questions to ask a financial advisor about retirement to make sure you are thinking about all the important issues and that your

This simple retirement calculator will help you quickly see if you are ready to retire. You can also use this retirement calculator to see how

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing

Preparing for retirement? This simple two-page retirement checklist will help you make sure you don’t miss any of the major things to consider when retiring.

Generally, 403(b) contributions are tax-deductible up to an annual limit set by the IRS each year. You may be allowed to deduct additional “catch up”

The Capital Asset Pricing Model, or CAPM, is a basic theoretical model for determining the expected return on a security or portfolio. This CAPM calculator

For the most part you get to decide what happens to your 403(b) when you quit or change jobs. You may be able to leave

Purchasing power risk is the possibility that you will not be able to buy as much with your savings in the future. It represents a

If you are wondering whether you can reinvest your required minimum distribution, then chances are you have one coming up that you realize you don’t

Taxes are an unavoidable truth of retirement planning and investing. However, avoiding capital gains tax on stocks is a good way to lower your total

You can use this future value calculator to find the future value of a lump sum or stream of regular savings. For example, if you

Your vested balance is the amount of money in your retirement account that belongs to you. If you quit your job or leave your employer, your

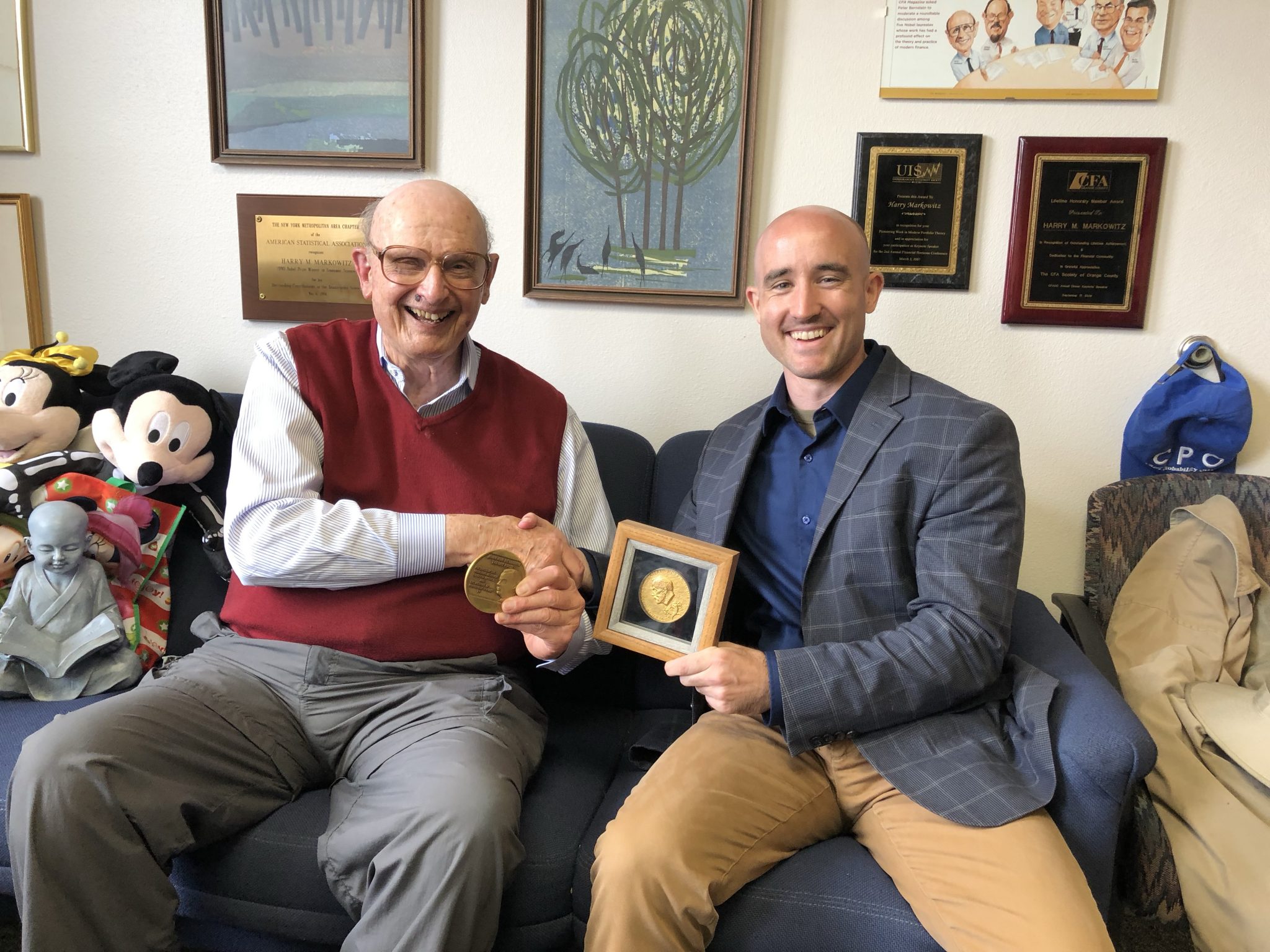

Fair warning, this post is a departure from my normal articles on retirement planning. I had an opportunity to meet one of the founding fathers

Callable bonds are bonds that the issuing corporation can redeem before maturity. If you hold a callable bond and the issuer decides to redeem it

Brandon Renfro LLC (“Belonging Wealth Management”) is a registered investment adviser offering fee only advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Brandon Renfro in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.All written content on this site is for information purposes only. Opinions expressed herein are solely those of Belonging Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.